10 financial decisions that will make the new year easier for you

10 financial decisions that will make the new year easier for you

The beginning of the year represents a symbolic fresh start and gives you the opportunity to analyze your habits and set a solid foundation for your finances. Financial decisions made during this period help you create a clear plan to achieve your wishes and goals. Proper allocation of funds from the very beginning allows you to focus on personal growth and financial balance. With Global Money Express, discover 10 financial decisions you can set at the start of the year.

1. A detailed review of planned expenses

The first step in any quality guide is understanding your exact starting point so you know where to direct your focus. Review your planned expenses and categorize them into:

-

essential needs such as housing, utilities, and food

-

expenses driven by personal preferences such as shopping or trips

This analysis will reveal patterns in your behavior and show where there is room for improvement and savings. Understanding your own habits is the best foundation for making smarter decisions in the months ahead.

2. Setting measurable goals for each quarter

Instead of general plans, define exact amounts you want to allocate for specific purposes in each part of the year. Clearly defined goals are

-

motivating

-

allow you to track your progress in real time throughout the year

Whether it is home improvement or travel, measurability is the key to the success of any financial strategy. When you have a clear vision, it is much easier to stay disciplined and focused on what truly brings value to your life.

3. Creating a calendar of major annual expenses

Many expenses can be anticipated in advance, such as

-

celebrations and family events

Enter these important dates into your calendar and estimate how much money you will need for each event so you can be prepared. Planning ahead ensures that each month passes without unexpected costs. This level of predictability allows you to maintain stability and a smooth flow of your household budget.

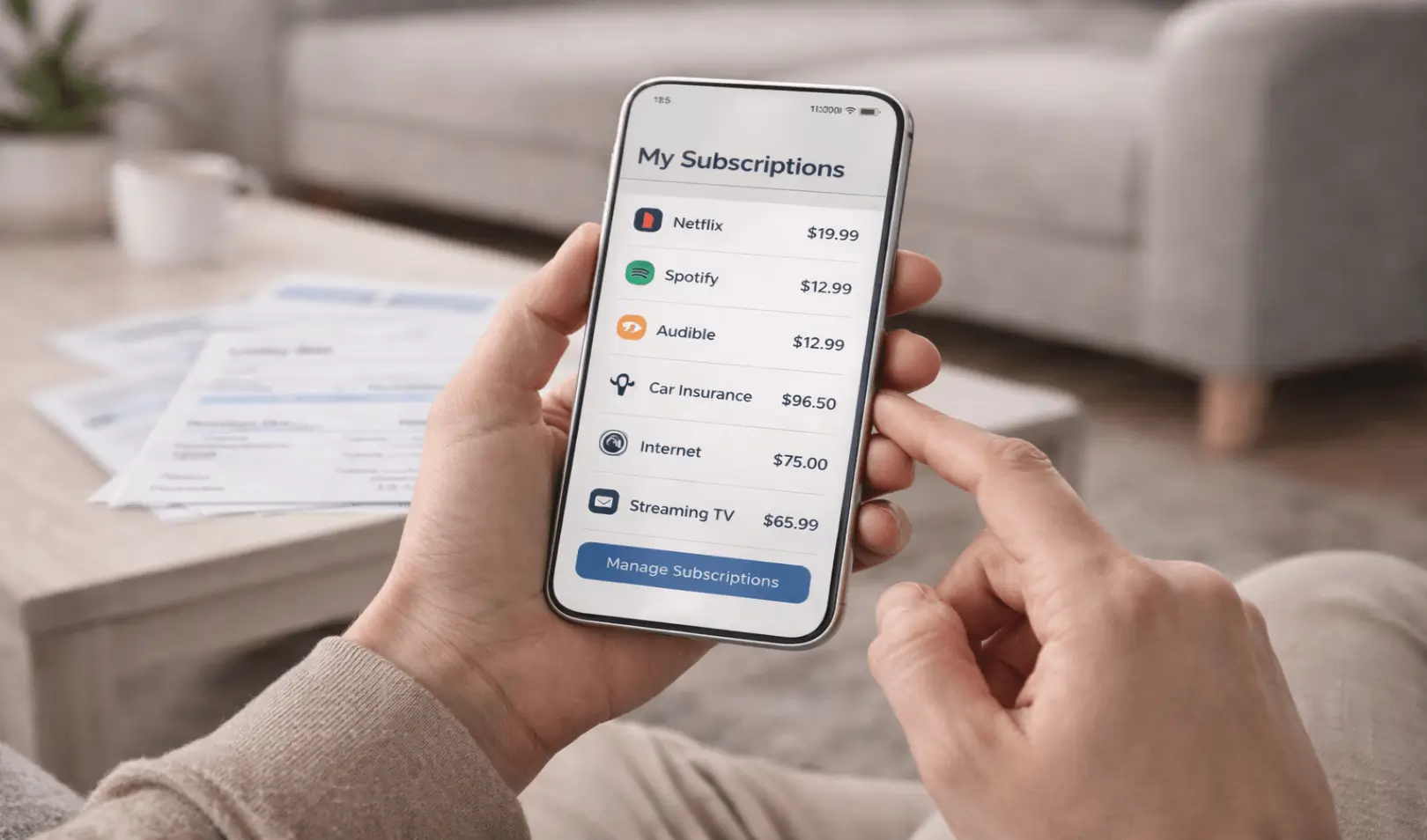

4. Optimizing monthly subscriptions and fixed bills

The beginning of the year is the perfect time to review all the services you pay for regularly, from

-

telecom packages

-

digital subscriptions

-

additional services that you no longer use

Canceling what no longer contributes to your daily quality of life frees up space for new opportunities. Even small adjustments to fixed expenses can result in significant funds for your goals over the course of a year. Be bold in redefining your needs and direct your money where it will work for you.

5. Introducing the “sleep on the decision” rule for major purchases

Impulse buying is one of the biggest drains on your personal budget, especially during seasonal sales periods. Introduce a rule that for any purchase above a certain amount, you must wait at least 24 to 48 hours before making a final decision. In most cases, the initial excitement will fade, and you will realize that you do not really need the item. This simple discipline can save you significant funds throughout the year and ensure that you buy only what you truly value and need.

6. Meal planning and smarter grocery shopping

Food costs make up a large portion of monthly household expenses and are often poorly organized. Start planning a weekly menu and shop according to a precise list to avoid food waste and unnecessary trips to the store. Buying seasonal produce and monitoring promotions for items you use frequently can lead to savings without reducing the quality of your diet. Both your body and your wallet will benefit from this organized change.

7. Invest in your own knowledge of resource management

Financial literacy is a lifelong skill that delivers the best returns. Take time to read expert articles, follow saving tips, and stay informed about new household budget management models. The more you understand how systems work, the more confident you will be in making everyday decisions. Education empowers you to recognize opportunities others overlook and to protect your interests in any situation.

8. Automating savings and building an emergency fund

One of the most effective financial decisions is turning saving into an automated process. When setting money aside becomes your first monthly activity, financial goals no longer depend on momentary motivation but on consistency. Automatic transfers help you build financial security effortlessly, even in months when expenses are higher than usual.

An emergency fund serves as personal financial protection when unexpected expenses arise, such as

-

household appliance repairs

-

car issues

-

other unforeseen obligations

Instead of these situations causing stress, a pre-built fund allows for a quick and calm response. It is advisable to start with smaller amounts and gradually increase savings until you reach a level that covers your basic needs.

This approach brings long-term stability and a sense of control over your finances, as you know you are prepared even for unplanned life situations.

9. Regular monthly review of achieved progress

A plan that is consistently monitored becomes your reality, so set aside time at the end of each month to review your achievements. Check whether you stayed within your planned limits and how much progress you made toward your goals for the year. If you notice the need for small adjustments, make them confidently, as planning is a dynamic process that evolves with you. Consistency in tracking progress brings a sense of pride and full control over your financial future.

10. Use flexible solutions when you need them

Life is dynamic, and sometimes, despite excellent planning, situations arise that require additional financial support and speed. In such moments, Global Money Express is your reliable partner, offering various support models such as fast loans or emergency loans for immediate needs. If your plans include larger projects you want to realize right away while repaying them comfortably, installment loans provide maximum flexibility. For specific situations, quick loans without employer certification and short-term loans are also available.

Faq - frequently asked questions

1. Why is it important to make financial decisions at the beginning of the new year?

The beginning of the new year is a natural period for planning and setting goals, as it brings a sense of a fresh start. Financial decisions made at this time are easier to implement throughout the year, with a clearer overview of income and expenses. Planning ahead also allows better preparation for major expenses and unexpected situations.

2. How important is it to have an emergency fund?

An emergency fund provides financial security and reduces stress during unexpected expenses. It does not need to be built all at once—it is important to start with smaller amounts and gradually increase it. Such a fund offers greater flexibility and stability in everyday life.

3. What is the simplest way to start planning?

The best way is to start by listing all planned monthly needs to get a clear picture of your possibilities.

4. How can wishes and possibilities be aligned most effectively?

The key is setting clear priorities and using options such as installment-based solutions for larger goals you want to achieve immediately.

Conclusion

Making thoughtful financial decisions does not mean giving things up, but creating a clearer and more secure framework for everyday life. The new year offers an opportunity to improve how you manage your money and to lay the foundation for a more stable period ahead. Small but consistent changes often bring the greatest results.

Through planning, expense tracking, and using available information, you can respond more easily to life situations, whether planned or unexpected. Global Money Express provides various financial options that can help you make appropriate decisions aligned with your needs and capabilities.

The new year can be financially simpler and calmer when you have a clear direction, realistic goals, and support when you need it.